- Bitcoin apps

- How to buy on cryptocom

- Bit coin price in us

- Cryptocurrency bitcoin price

- Cryptocoin com coin

- When to buy bitcoin

- Where to buy gyen crypto

- Ethereum candlestick chart

- How to buy crypto

- Buy ethereum with credit card

- Today's bitcoin cash price

- 1 etherium to usd

- Cryptocom cards

- Buy btc

- Cryptocom card

- Where to buy crypto

- Largest bitcoin holders

- Ethusd converter

- Where to buy ethereum

- 1bitcoin to dollar

- How to buy safemoon on cryptocom app

- Crypto exchange

- Bitcoin one percent controls all circulating

- What is ethereum trading at

- Metaverse coins on cryptocom

- Cryptocom payment methods

- Crypto com not working

- What app can i buy dogecoin

- Dogecoin 20 where to buy

- How to sell on cryptocom

- Btt crypto price

- Btc mining

- Safe btc crypto

- Bitcoin cryptocurrency

- Selling crypto

- Cryptocurrency exchanges

- Dot crypto

- Buy physical bitcoin

- Polygon crypto

- Where to sell dogecoin

- Price of ethereum today

- Safe dollar crypto

- How much is bitcoin

- Apps cryptocurrency

- How to close crypto com account

- Eternal crypto

- Crypto card

- Bit price

- Cryptos

- Coinbase cryptocurrency prices

- Bitcoin historical price

- Price of ethereum

- Tether to usd

- Does cryptocom charge fees

Price of ethereum

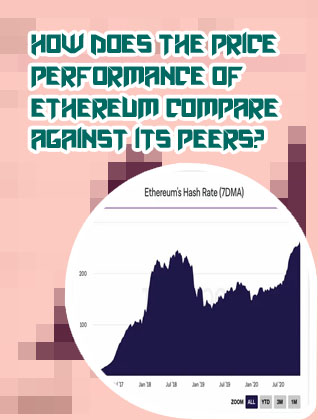

As the price of Ethereum continues to fluctuate, it's important to stay informed on the latest news and analysis to make informed decisions. Here are four articles that provide valuable insights and perspectives on the price of Ethereum:

Understanding the Factors Influencing Ethereum's Price Movement

none

Analyzing the Impact of Market Trends on Ethereum's Price

Ethereum, one of the most well-known cryptocurrencies in the market, has been greatly influenced by various market trends over the years. As a decentralized platform that enables smart contracts and decentralized applications to be built and operated without any downtime, censorship, fraud, or third party interference, Ethereum's price is highly sensitive to market fluctuations.

One key market trend that has significantly impacted Ethereum's price is the rise of decentralized finance (DeFi) projects. The increasing popularity of DeFi platforms built on the Ethereum network has led to a surge in demand for Ether, the native cryptocurrency of Ethereum. This surge in demand has subsequently driven up the price of Ether, making it one of the best-performing cryptocurrencies in recent years.

Another market trend that has influenced Ethereum's price is the growing interest from institutional investors. As more institutional investors and large corporations show interest in cryptocurrencies as a store of value and investment asset, Ethereum has seen a significant increase in demand. This has helped to stabilize Ethereum's price and increase its market capitalization.

In conclusion, analyzing the impact of market trends on Ethereum's price is crucial for investors and traders looking to understand the factors driving the cryptocurrency's value. By staying informed about market trends such as DeFi projects and institutional interest, investors can make more informed decisions about

Expert Predictions on the Future Price of Ethereum

As the cryptocurrency market continues to evolve, many experts have weighed in on the future price of Ethereum. With its strong technology and widespread adoption, Ethereum has the potential to see significant growth in the coming years. According to industry insiders, Ethereum's price could reach new heights due to its innovative smart contract capabilities and decentralized applications.

One practical use case for Ethereum's technology is in the realm of decentralized finance (DeFi). By utilizing Ethereum's blockchain, individuals can access a wide range of financial services without the need for traditional intermediaries. For example, users can borrow and lend funds, trade digital assets, and earn interest through DeFi protocols. This has led to a positive result for many investors who have seen significant profits by participating in the DeFi ecosystem.

While it is important to consider the risks involved in investing in cryptocurrencies, Ethereum's potential for growth and innovation cannot be overlooked. With the ongoing development of its network and the increasing demand for decentralized applications, Ethereum could prove to be a valuable asset in the future. Investors and enthusiasts alike are keeping a close eye on Ethereum's price movements, eagerly anticipating what the future may hold for this groundbreaking technology.

Strategies for Managing Risks in Ethereum Price Volatility

Ethereum, the second largest cryptocurrency by market capitalization, has experienced significant price volatility since its inception. This volatility can present both opportunities and risks for investors and traders alike. In order to navigate this volatility effectively, it is crucial to have a well-thought-out risk management strategy in place.

One of the key strategies for managing risks in Ethereum price volatility is diversification. By spreading your investments across different assets, you can reduce the impact of price fluctuations in any one asset on your overall portfolio. This can help mitigate the risk of loss during periods of extreme volatility.

Another important strategy is setting stop-loss orders. These orders automatically sell your Ethereum holdings if the price reaches a certain predetermined level. This can help protect your investment from sudden and significant price drops.

Additionally, staying informed about market trends and news related to Ethereum can help you make more informed decisions about when to buy or sell. Keeping up-to-date with developments in the Ethereum ecosystem, such as upgrades and partnerships, can give you a better understanding of the factors influencing price movements.

In conclusion, managing risks in Ethereum price volatility requires a combination of diversification, setting stop-loss orders, and staying informed about market trends. By implementing these strategies, investors can better navigate the ups and downs of the Ethereum market and reduce