- Bitcoin apps

- How to buy on cryptocom

- Bit coin price in us

- Cryptocurrency bitcoin price

- Cryptocoin com coin

- When to buy bitcoin

- Where to buy gyen crypto

- Ethereum candlestick chart

- How to buy crypto

- Buy ethereum with credit card

- Today's bitcoin cash price

- 1 etherium to usd

- Cryptocom cards

- Buy btc

- Cryptocom card

- Where to buy crypto

- Largest bitcoin holders

- Ethusd converter

- Where to buy ethereum

- 1bitcoin to dollar

- How to buy safemoon on cryptocom app

- Crypto exchange

- Bitcoin one percent controls all circulating

- What is ethereum trading at

- Metaverse coins on cryptocom

- Cryptocom payment methods

- Crypto com not working

- What app can i buy dogecoin

- Dogecoin 20 where to buy

- How to sell on cryptocom

- Btt crypto price

- Btc mining

- Safe btc crypto

- Bitcoin cryptocurrency

- Selling crypto

- Cryptocurrency exchanges

- Dot crypto

- Buy physical bitcoin

- Polygon crypto

- Where to sell dogecoin

- Price of ethereum today

- Safe dollar crypto

- How much is bitcoin

- Apps cryptocurrency

- How to close crypto com account

- Eternal crypto

- Crypto card

- Bit price

- Cryptos

- Coinbase cryptocurrency prices

- Bitcoin historical price

- Price of ethereum

- Tether to usd

- Does cryptocom charge fees

Crypto by market cap

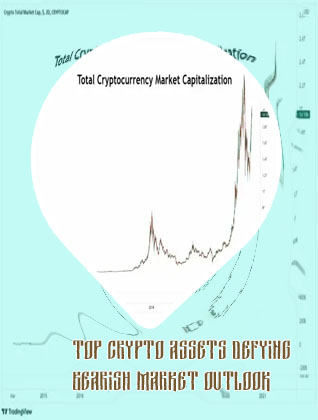

When it comes to exploring the world of cryptocurrencies, understanding the concept of market capitalization is crucial. Market cap refers to the total value of a cryptocurrency, calculated by multiplying the current price of a coin by its total circulating supply. In this list of articles, we will delve into the topic of "Crypto by market cap" to provide valuable insights and information on how market cap influences the cryptocurrency market.

The Importance of Market Cap in the Cryptocurrency World

In the fast-paced and ever-evolving world of cryptocurrency, market capitalization plays a crucial role in determining the value and potential of a digital asset. Market cap refers to the total value of a cryptocurrency in circulation, calculated by multiplying the current price per unit by the total number of coins in existence. This metric provides investors with valuable insight into the size and stability of a particular cryptocurrency, helping them make informed decisions about their investments.

Understanding market cap is essential for anyone looking to navigate the complex world of cryptocurrency trading. A high market cap typically indicates a more established and widely accepted cryptocurrency, while a low market cap may suggest a newer or riskier asset. Investors often use market cap as a key indicator of a cryptocurrency's potential for growth and profitability.

For example, John Smith, a resident of London, believes that market cap is a crucial factor to consider when investing in cryptocurrencies. He notes that larger market cap coins like Bitcoin and Ethereum are generally seen as more stable and reliable investments, while smaller market cap coins may offer greater potential for high returns but also come with higher risks.

Overall, market cap is a fundamental concept that all cryptocurrency investors should be familiar with. By understanding the importance of market cap, investors can make more informed decisions and navigate the volatile world of cryptocurrency with confidence

Top 5 Cryptocurrencies by Market Cap in 2021

In the dynamic world of cryptocurrencies, it is crucial to stay informed about the top players in the market. As of 2021, the top 5 cryptocurrencies by market cap are Bitcoin, Ethereum, Binance Coin, Cardano, and Tether.

Bitcoin, often referred to as digital gold, continues to dominate the market with its first-mover advantage and widespread adoption. Ethereum, on the other hand, stands out for its smart contract capabilities and decentralized applications. Binance Coin has gained popularity due to its utility within the Binance ecosystem, offering discounts on trading fees. Cardano is known for its focus on sustainability and scalability, aiming to provide a secure and scalable platform for smart contracts. Tether, a stablecoin pegged to the US dollar, provides stability in the volatile cryptocurrency market.

Investors looking to diversify their portfolios should consider these top 5 cryptocurrencies due to their strong market presence and unique characteristics. It is essential to conduct thorough research and monitor market trends to make informed investment decisions in the volatile world of cryptocurrencies.

In order to better understand the content of this article, readers should consider exploring the technological advancements behind each cryptocurrency, analyzing their potential for mass adoption, and staying updated on regulatory developments affecting the market. By delving deeper into these topics,

How to Analyze Cryptocurrencies Based on Market Cap Trends

none