- Bitcoin apps

- How to buy on cryptocom

- Bit coin price in us

- Cryptocurrency bitcoin price

- Cryptocoin com coin

- When to buy bitcoin

- Where to buy gyen crypto

- Ethereum candlestick chart

- How to buy crypto

- Buy ethereum with credit card

- Today's bitcoin cash price

- 1 etherium to usd

- Cryptocom cards

- Buy btc

- Cryptocom card

- Where to buy crypto

- Largest bitcoin holders

- Ethusd converter

- Where to buy ethereum

- 1bitcoin to dollar

- How to buy safemoon on cryptocom app

- Crypto exchange

- Bitcoin one percent controls all circulating

- What is ethereum trading at

- Metaverse coins on cryptocom

- Cryptocom payment methods

- Crypto com not working

- What app can i buy dogecoin

- Dogecoin 20 where to buy

- How to sell on cryptocom

- Btt crypto price

- Btc mining

- Safe btc crypto

- Bitcoin cryptocurrency

- Selling crypto

- Cryptocurrency exchanges

- Dot crypto

- Buy physical bitcoin

- Polygon crypto

- Where to sell dogecoin

- Price of ethereum today

- Safe dollar crypto

- How much is bitcoin

- Apps cryptocurrency

- How to close crypto com account

- Eternal crypto

- Crypto card

- Bit price

- Cryptos

- Coinbase cryptocurrency prices

- Bitcoin historical price

- Price of ethereum

- Tether to usd

- Does cryptocom charge fees

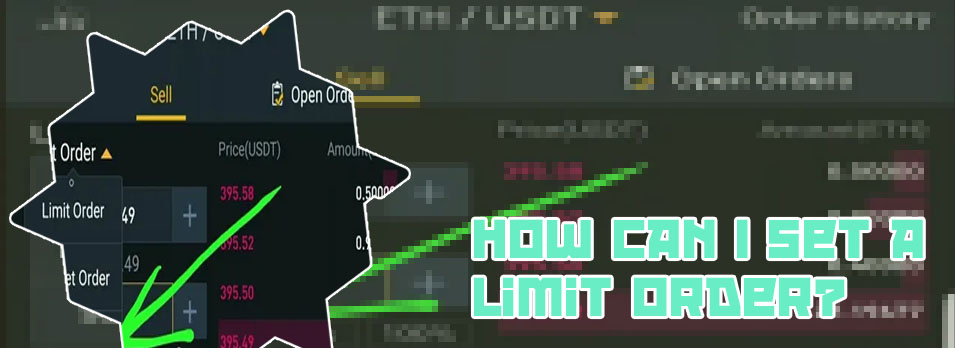

Crypto com limit order

If you're looking to learn more about how to place limit orders on Crypto.com, then you've come to the right place. In this list, we have compiled four articles that will provide you with valuable information on how to effectively use limit orders on the Crypto.com platform. From step-by-step guides to tips and tricks, these articles will help you navigate the world of limit orders in the world of cryptocurrency trading.

Mastering Limit Orders on Crypto.com: A Comprehensive Guide

Crypto.com has become one of the most popular platforms for trading cryptocurrencies, offering a wide range of features to help users navigate the volatile market. One of the key tools available to traders on Crypto.com is the limit order, which allows users to set specific conditions for buying or selling a particular cryptocurrency.

In this comprehensive guide, users will learn how to master limit orders on Crypto.com, enabling them to take advantage of market fluctuations and secure the best possible prices for their trades. The guide covers everything from the basics of limit orders to advanced strategies for maximizing profits and minimizing risks.

By following the step-by-step instructions provided in this guide, users can gain a deeper understanding of how limit orders work and how they can be used to their advantage in the world of cryptocurrency trading. Whether you are a beginner looking to dip your toes into the market or an experienced trader seeking to fine-tune your strategies, this guide has something to offer for everyone.

Overall, "Mastering Limit Orders on Crypto.com: A Comprehensive Guide" is an essential resource for anyone looking to make the most of their trading experience on Crypto.com. By mastering the art of limit orders, users can gain a competitive edge in the market and achieve their financial goals with confidence and precision.

Top Strategies for Placing Limit Orders on Crypto.com

Cryptocurrency trading can be a volatile and complex endeavor, but with the right strategies in place, investors can maximize their profits and minimize risks. One key tool that traders can utilize is placing limit orders on platforms such as Crypto.com.

Limit orders allow traders to set a specific price at which they are willing to buy or sell a particular cryptocurrency. By using limit orders, traders can avoid the pitfalls of market orders, which can result in unfavorable prices due to sudden price fluctuations.

One effective strategy for placing limit orders is to utilize technical analysis. By analyzing price charts and identifying key support and resistance levels, traders can set their limit orders at strategic price points. This allows traders to take advantage of potential price movements and execute trades at optimal prices.

Another important strategy is to diversify limit orders across different cryptocurrencies. By spreading out limit orders across multiple assets, traders can minimize their exposure to any single cryptocurrency and reduce the impact of unexpected price fluctuations.

Overall, mastering the art of placing limit orders on Crypto.com can significantly enhance a trader's success in the volatile world of cryptocurrency trading. By utilizing strategies such as technical analysis and diversification, traders can increase their profitability and mitigate risks in this fast-paced market.

Common Mistakes to Avoid When Using Limit Orders on Crypto.com

none

Advanced Tips for Maximizing Profits with Limit Orders on Crypto.com

Crypto trading can be a lucrative endeavor for those who understand the ins and outs of the market. One strategy that can help traders maximize profits is using limit orders on platforms like Crypto.com. Limit orders allow traders to set a specific price at which they are willing to buy or sell a cryptocurrency, ensuring that they get the best possible price for their trades.

One advanced tip for maximizing profits with limit orders on Crypto.com is to use a combination of limit orders and stop-loss orders. By setting a stop-loss order, traders can protect their profits and minimize losses in case the market moves against them. This strategy is especially useful in volatile markets where prices can change rapidly.

Another tip is to take advantage of market trends and news events to make informed trading decisions. By staying up to date with the latest developments in the crypto world, traders can capitalize on opportunities and avoid potential pitfalls. For example, when a major exchange announces support for a new cryptocurrency, prices of that coin are likely to surge, presenting a profitable trading opportunity.

Additionally, traders can use technical analysis tools to identify key support and resistance levels and make more accurate predictions about price movements. By combining these tools with limit orders, traders can increase their chances of making profitable trades on Crypto.com.